Deposit Check by Chase Mobile Deposit Again in Person

Hunt Mobile Deposit: Limits, Fees, and How Long It Takes

- How Long Does It Take

- How It Works

- Pros and Cons

- Should You Utilise Hunt Mobile Cheque Deposit?

RyanJLane / Getty Images

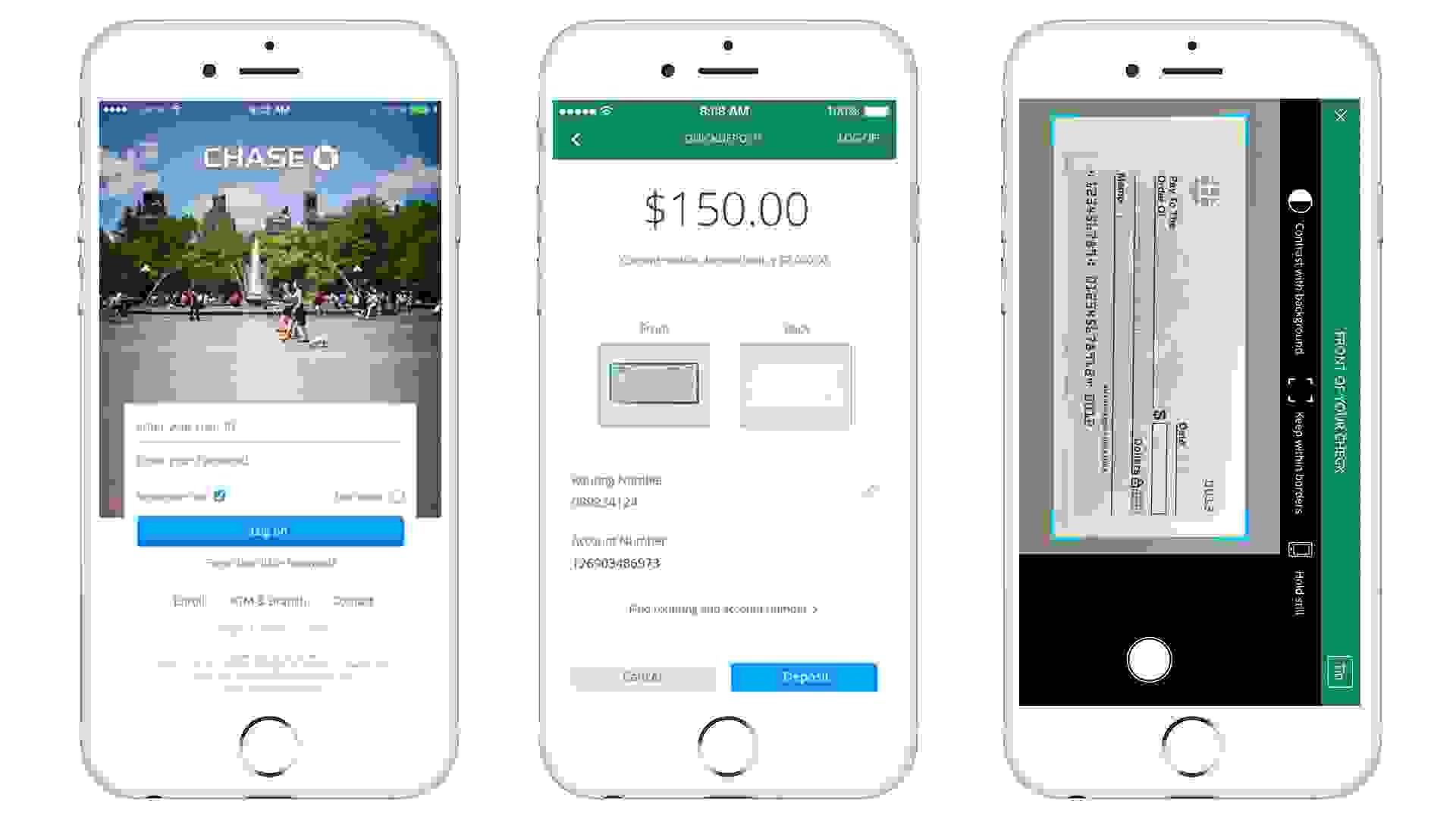

Chase QuickDeposit, the mobile deposit app offered by Chase Bank, makes depositing checks fast and piece of cake, saving you from having to get to a banking company branch or ATM. If you're new to Chase, you might have questions about how the app works. Here'southward a closer look at its features and benefits.

How Long Does Hunt Mobile Deposit Have?

If yous eolith the check earlier 11 p.m. EST on a concern twenty-four hour period, your funds should exist available the next business day. Checks deposited after 11 p.k. EST or on a weekend or holiday are candy the side by side business day simply non necessarily available.

In some cases, Chase delays access to deposited funds. The funds won't be bachelor until after the bank reviews the deposit.

How Does Hunt Mobile Deposit Piece of work?

Chase QuickDeposit lets you deposit checks through the mobile app. To use the service, you must first download the app to your smartphone or tablet. You also need to register your Chase online account. Once that's washed, follow these steps to deposit a check using Hunt QuickDeposit.

Step-past-Step Guide to Using Hunt QuickDeposit

- Log in to the Chase Mobile App with your username and password.

- Choose "Deposit Checks" from the navigation menu in the app.

- Select the account where you desire to deposit the check.

- Enter the dollar amount of your deposit. Double-check the number you enter and pay attention to the placement of the decimal point.

- Tap "Front" and accept a picture of the front of the check, so repeat the process to take a picture of the back of the bank check with your endorsement. Brand certain you endorse the bank check correctly.

- Verify the data and submit the deposit.

- You should receive two emails from Chase after submitting the deposit. The first confirms receipt of the eolith, and the second lets you know when the deposit has been accepted.

If at that place is a problem with the eolith, you will receive a separate email that explains what the trouble was or why the deposit was rejected. The availability of your funds might exist delayed if in that location'south a problem with the eolith.

Chase offers back up through its website. There is likewise a how-to video in the app that shows you lot how to use mobile check deposit.

What Happens To the Deposited Check?

Always continue the paper check until you encounter the bachelor funds in your account, just in case something goes wrong. Chase recommends you destroy information technology immediately after the funds take been posted to your business relationship.

But before you do that, you might desire to check with your tax professional or lawyer to meet if at that place'southward a reason to keep your checks. Shred or destroy the checks before throwing them in the trash.

Benefits and Drawbacks of Hunt Mobile Deposit

The popularity of online cyberbanking, directly deposit and person-to-person transfer services has reduced the number of checks that people receive. You lot may receive checks but a few times a twelvemonth, if at all. In that case, stopping by a bank co-operative or ATM to deposit them might not be a big bargain.

It helps to counterbalance the pros and cons of Chase mobile deposit if you're however not certain you want to use information technology. Here's a quick expect:

Pros

If you've been using online cyberbanking services, y'all'll detect that mobile deposit offers many of the same benefits. Hither are some of the pros of using mobile eolith:

- Convenience: You can deposit a cheque wherever yous are without having to visit a branch or ATM.

- Security: Passwords, check eolith data and images are not stored on the device.

- Accessibility: The Chase QuickDeposit app is available for download on Apple tree and Android devices.

Cons

In some cases, mobile deposit might not exist a good choice for you lot. Here are a few cons to consider:

- You must accept a smartphone or tablet with at least a iv-megapixel rear-facing photographic camera to apply mobile bank check eolith.

- You need to keep paper copies of checks until the deposits are accepted and must keep track of which checks y'all've deposited.

- Messaging and data rates may apply, depending on the terms of your phone'southward information plan.

Should You Apply Chase Mobile Cheque Deposit?

If yous already use online banking, then mobile check eolith should exist a snap. In fact, you probably already have Chase's app available. Unless you prefer doing business at a local Chase branch or ATM, you lot should consider using Chase mobile deposit considering of the convenience of depositing a check at any time or location.

The downside is that you need internet access and a plan for keeping rails of which checks you've deposited. Unlike when you deposit at a banking company or ATM, y'all'll yet have the paper cheque in your hand after the mobile eolith is fabricated.

This article has been updated with additional reporting since its original publication.

Data is accurate equally of Mar. 21, 2022.

Editorial Note: This content is not provided or commissioned by the depository financial institution advertiser. Opinions expressed here are author's alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may exist compensated through the bank advertiser Chapter Program.

Cheque Out Our Costless Newsletters!

Every day, get fresh ideas on how to salvage and make money and achieve your fiscal goals.

Source: https://www.gobankingrates.com/banking/mobile/chase-mobile-deposit/

0 Response to "Deposit Check by Chase Mobile Deposit Again in Person"

Post a Comment